Автор

James B. Steele — новинки

-

Howard Hughes: His Life and Madness Дональд Л. Барлетт, James B. Steele

ISBN: 978-0393326024 Год издания: 2004 Издательство: W. W. Norton & Company Язык: Английский The life that inspired the major motion picture. The Aviator, starring Leonardo Di Caprio and directed by Martin Scorsese. Howard Hughes has always fascinated the public with his mixture of secrecy, dashing lifestyle, and reclusiveness. This is the book that breaks through the image to get at the man. 80 photographs. Originally published under the title Empire: The Life, Legend, and Madness of Howard Hughes. -

Howard Hughes: His Life and Madness Дональд Л. Барлетт, James B. Steele

ISBN: 978-0233051284 Год издания: 2003 Издательство: Carlton Books Язык: Английский Howard Hughes has always fascinated the public with his mixture of secrecy, dashing lifestyle, and reclusiveness. This is the book that breaks through the image to get at the man. Originally published under the title Empire: The Life, Legend, and Madness of Howard Hughes. -

The Great American Tax Dodge: How Spiraling Fraud and Avoidance Are Killing Fairness, Destroying the Income Tax, and Costing You Дональд Л. Барлетт, James B. Steele

ISBN: 978-0520236103 Год издания: 2002 Издательство: University of California Press Язык: Английский In The Great American Tax Dodge, a book that should infuriate and galvanize citizens everywhere, the best-selling authors of America: What Went Wrong? expose the millions of Americans who are dodging their income taxes at every honest taxpayer's expense. With the clarity, insight, and readability that earned them two Pulitzer Prizes, Donald Barlett and James Steele explain how Americans are cheating as never before, and why most are getting away with it.

The authors relate the stories of a Manhattan couple who spent $1 million a month to maintain their lifestyle yet never paid income tax, a California couple who provided sport utility vehicles for their children at taxpayers' expense, an entrepreneur in Costa Rica who shows Americans how to hide their money in clandestine accounts offshore, and computer technicians at America's largest corporations who live tax-free.

Barlett and Steele describe how the Internet has democratized tax cheating, as proliferating Web sites and their often mysterious operators offer every service imaginable to escape taxes. They discuss the double standard the IRS employs in tax audits--one for the rich and well-connected and another for everyone else--and how the Justice Department tries to jail powerless citizens accused of tax law violations while allowing the wealthy and influential to go free. This book also documents how Congress is deliberately undermining the income tax in order to replace it with a system that will provide the largest windfall ever for the richest Americans--and increase the burden on everyone else. And it spells out how executives like Kenneth L. Lay bankrolled campaigns to institute such a tax system, based on accounting principles eerily similar to those employed at Lay's Enron Corporation. Finally, the authors consider our chances for reestablishing what was once the fairest tax system in the world. -

America: Who Really Pays the Taxes? Дональд Л. Барлетт, James B. Steele

ISBN: 978-0671871574 Год издания: 1994 Издательство: Simon & Schuster Язык: Английский Originally designed to spread the cost of government fairly, our tax code has turned into a gold mine of loopholes and giveaways manipulated by the influential and wealthy for their own benefit. If you feel as if the tax laws are rigged against the average taxpayer, you're right:

Middle-income taxpayers pick up a growing share of the nation’s tax bill, while our most profitable corporations pay little or nothing.

Your tax status is affected more by how many lawyers and lobbyists you can afford than by your resources or needs.

Our best-known and most successful companies pay more taxes to foreign governments than to our own.

Cities and states start bidding wars to attract business through tax breaks—taxes made up for by the American taxpayer.

Who really pays the taxes? Barlett and Stelle, authors of the bestselling America: What Went Wrong?, offer a graphic exposé of what’s wrong with our tax system, how it got that way, and how to fix it. -

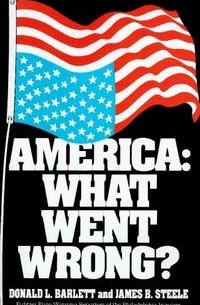

America: What Went Wrong? Дональд Л. Барлетт, James B. Steele

ISBN: 978-0836270013 Год издания: 1992 Издательство: Andrews McMeel Publishing Язык: Английский America: What Went Wrong? is a solid indictment of how the rulemakers in Washington and the dealmakers on Wall Street have changed the rules of the game to favor the privileged, the powerful, and the influential-at the expense of everyone